As demand for critical minerals accelerates, so does the pressure to find smarter, more sustainable ways to source them. The opportunity? Turning mining waste or by-product materials from oil drilling or power generation into valuable resources: offsetting costs, extending supply, and advancing circular economy strategies that benefit business, people, and planet. Across the world, companies that rethink by-products and invest in closed-loop systems are gaining a competitive edge.

At Arcadis, we help clients unlock these opportunities, transforming operations to reduce risk, recover value, and build long-term resilience in a rapidly evolving global market.

What are critical minerals?

Critical minerals like lithium, nickel, cobalt, manganese, and graphite are the essential building blocks of modern technologies. From batteries and wind turbines to semiconductors and defense systems, they are vital to powering the global energy transition and securing industrial and digital infrastructure.

What makes them “critical” is not just their utility but their vulnerability. Many are produced in a small number of countries, difficult to substitute, and exposed to geopolitical risk and supply-chain volatility.

As demand grows, so does the urgency to diversify sources and rethink the full lifecycle of these materials.

Why demand is growing

According to the International Energy Agency (IEA), the world could need four times as many critical minerals for clean energy technologies by 2040 under current policy targets—and even more under net-zero scenarios.

How governments are responding

In response, countries are stepping up. The United States has expanded its critical minerals list to 50, launched federal incentives through Executive Orders and is working to strengthen domestic supply through innovation and investment. The UK has introduced a Critical Minerals Strategy to improve resilience through recycling, substitution, and international partnerships. Meanwhile, the European Union has adopted the Critical Raw Materials Act, aiming to ensure at least 10% of strategic minerals are extracted, and 15% recycled, within the EU by 2030.

These policies reflect a shift toward lifecycle thinking, one that prioritizes circular-economy models, innovation partnerships, and sustainable recovery of materials.

Critical minerals and waste revenue

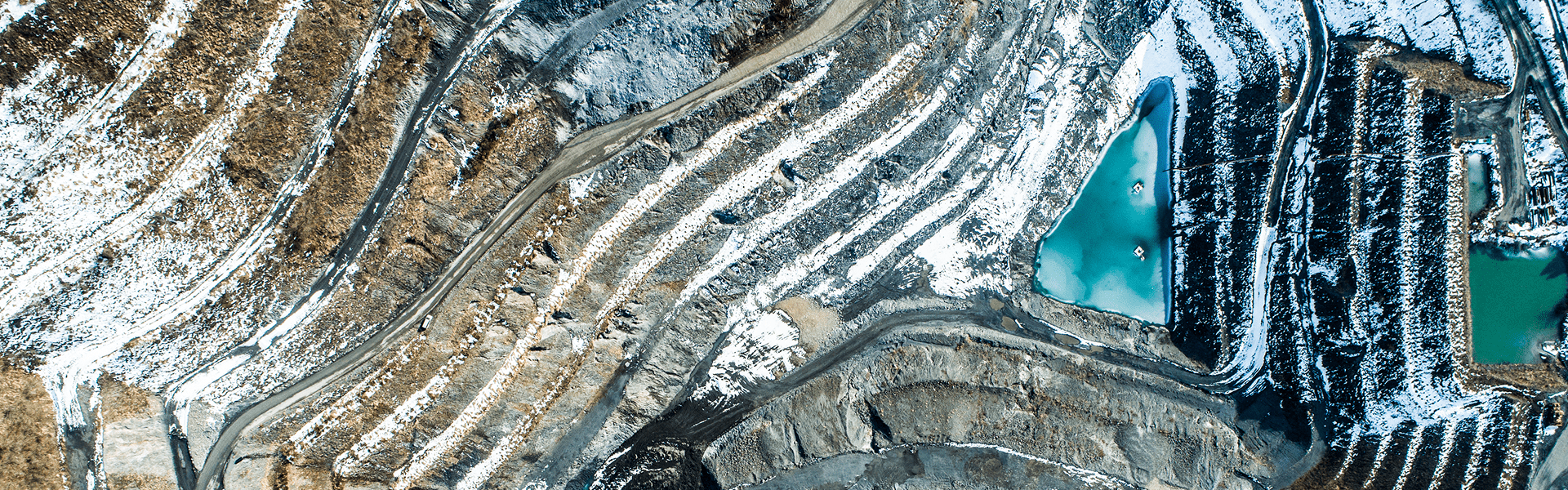

Traditionally, mining focused on extracting primary commodities, and managing low-grade ore, tailings, and by-products as wastes. Today, these materials are being reevaluated. With demand rising, what was once waste may now hold untapped value.

By adopting a circular mindset, mining companies can reduce environmental liabilities and create new revenue streams.

-

What by-products can offer

Mining by-products can contain valuable trace elements used in clean-energy technologies, electronics and advanced manufacturing, and battery and magnet production. Recovering these secondary materials often has a lower cost and carbon footprint than primary extraction.

-

Turning waste into value

Leading operators are adopting several strategies:

Tailings reprocessing: using advanced technologies to extract minerals from historical waste

Stockpile assessment: analyzing legacy waste for commercial recovery

On-site recovery systems: implementing modular systems to process waste at source

Evaluating water treatment systems: identifying opportunities to recover critical minerals directly from water, and in water treatment residuals

Partnerships and offtake agreements: collaborating with recyclers and refiners to close material loops.

-

The business case

Transforming waste into revenue isn’t just environmentally responsible. It makes strategic and financial sense too. By recovering valuable materials from byproducts, mining companies can offset operational costs, reduce the need for new extraction projects, and strengthen long-term resource security. It also supports ESG performance and helps build stakeholder confidence in an increasingly sustainability-focused market.

Arcadis has helped clients around the world unlock these opportunities. We’ve assessed tailings from legacy mining operations to identify commercially viable reprocessing strategies and delivered circular design solutions that reduce environmental risk while recovering high-value materials. In many cases, we’ve partnered with operators to embed waste-to-resource thinking into feasibility studies and permitting processes, ensuring that sustainability and profitability go hand in hand.

These solutions turn legacy challenges into future-facing advantages, aligning operational resilience with the evolving demands of a resource-constrained and climate-conscious global economy.

The circular economy and critical minerals

The traditional extract-and-dispose model is no longer viable in an era of rising demand and environmental scrutiny. Circular economy provides an alternative, keeping materials in use longer, reducing waste, and lowering reliance on virgin extraction.

Circular approaches focus on:

![]() extending asset life through repair and remanufacturing

extending asset life through repair and remanufacturing

This model supports sustainability and mining by lowering environmental impacts and creating more resilient supply chains.

Sector-specific applications of critical minerals

Critical minerals are essential to the technologies that power modern life, especially in the energy, minerals, and power sectors.

-

Powering the energy transition

The link between critical minerals and energy transition is direct. Key low-carbon technologies depend on specific minerals:

Lithium, nickel, and graphite: battery storage

Rare-earth elements: magnets for wind turbines and EVs

Copper: renewable-energy transmission and smart-grid systems.

A secure supply of these materials is essential for decarbonization.

-

Strengthening mining operations

In the minerals sector, critical-mineral demand is driving a shift in priorities. Companies are rethinking mine plans, investing in downstream processing and recovering materials from tailings. These steps help diversify revenue, meet sustainability goals, and improve corporate resilience.

-

Supporting power infrastructure

As power grids modernize, demand for critical minerals is rising. Transmission upgrades, smart grids, and distributed energy all require inputs that are in limited supply. Companies that secure access through innovation, recycling, or strategic partnerships will be better positioned to lead.

Challenges and opportunities in critical minerals

As demand increases, so do the challenges, particularly around supply-chain security and regulation. With processing often concentrated in a few countries, global markets are exposed to geopolitical risk and trade barriers.

New laws are also raising expectations for domestic sourcing and ESG compliance. Companies must respond quickly, balancing regulatory demands with competitive strategy.

-

How experts are helping

Energy and resources experts guide organizations to diversify supply chains, strengthen regional production, and embed circular strategies to enhance resilience.

Meanwhile, innovation is creating new opportunities. AI-powered exploration, advanced refining, and digital traceability are changing how materials are sourced and managed. New partnerships and business models are emerging to enable smarter, more sustainable use of resources.

For future-focused companies, these changes are not just risk mitigation; they are an opportunity to lead in a resource-efficient, climate-aligned economy.

From challenge to competitive edge

Demand for critical minerals presents both a challenge and a transformative opportunity. Companies that embrace circularity, recover value from waste, and invest in resilience will be best placed to thrive in a low-carbon world.

At Arcadis we help clients turn these opportunities into long-term advantage through sustainable mining solutions, innovative recovery strategies, and deep expertise in energy and resources.

Let’s turn critical minerals into critical value.

Webinar (Jan28th) - "Unlocking the Value From Critical Minerals: A Business Playbook"

Discover how to transform waste into revenue and resilience with actionable insights from experts like Will McHale (Mosaic Water Systems), Anne Thatcher, and Jeffrey Gillow (Arcadis). Learn proven strategies for critical minerals recovery that boost sustainability and business performance.